Form 4868 - An Overview

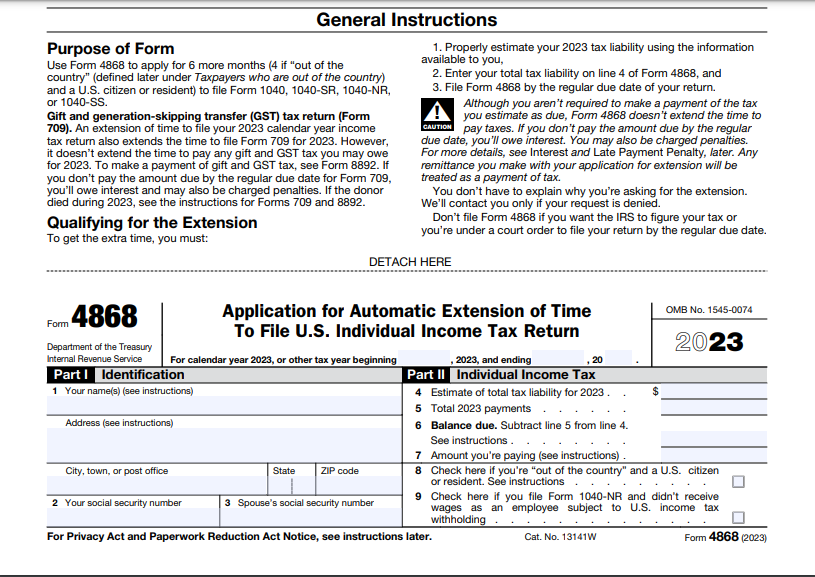

Form 4868 is an application for requesting an IRS extension of time to file a U.S Individual income tax return.

When you E-file Form 4868, the IRS grants you 6 months additional time to file your Individual Income tax return.

Note: Form 4868 does not extend the deadline for payment of any taxes owed.

Form 4868 Filing Due Date

The actual due date to file your Personal Tax Extension Form 4868 is April 15.

If you’re out of the country or calendar tax year filer, the deadline is June 15 .

Visit https://www.expressextension.com/irs-income-tax-extension/ to know more.

Form 4868 is applicable for

- Federal Income Tax Return Filers (1040, 1040A, 1040-EZ, 1040NR, 1040NR-EZ, 1040-PR or 1040-SS)

- 1099 Independent Contractors

- Sole Proprietorships (Schedule C)

- Single-Member LLC

Advantages of E-filing Over Paper Filing

- Quick Processing

- Track Status of your return

- Avoid typo errors

Form 4868 E-Filing Requirements

To E-file 4868 individuals should have the following information readily available.

- Personal Details such as Name, SSN, and Address

- If You are filing jointly, You will need the same information for your spouse.

- Total tax liability & Payment for your 2023 tax year.

- Balance due if any

Note: Make sure that your SSN matches with the IRS Database. Also, You can verify your information with the IRS by calling 1-800-829-4933.

About efile4868online.com

Efile4868online.com is an IRS Authorized e-file provider that offers a simple and secure way to file Form 4868 online. Our step-by-step filing process with clear instructions helps you to e-file your Form 4868 accurately. With our cloud based software, you can file your returns from anywhere and at any time.

Our internal audit check system helps you to avoid common errors and ensure accurate 1040 extension filings. The IRS provides you the status instantly once the form is transmitted to the IRS.

Tax Extension Solution for Tax Professionals

We provide more exclusive features for tax professionals to simplify the 4868 tax extension filing for their clients.

- Secure Bulk Upload Capabilities

- Volume Based Pricing

- Dedicated Account Manager

- Track the filing status of each client

Advantages when you File Form 4868 Online

IRS Authorized E-file Provider

Quick Processing

Instant IRS Approval

Automatic Extension

Options to Pay Balance Due

File from any Device

Instant Email/Text Notification

Re-transmit Rejected Returns for Free

How to File Form 4868 electronically

- Step 1: Select the IRS tax extension type you would like to file.

(Either individual or joint filing) - Step 2: Enter Your Personal Details

- Step 3: Enter payment details if you owe any taxes

- Step 4: Review your Form

- Step 5: Transmit your 1040 extension Form to the IRS

E-file Form 4868 with our Software and extend your 1040 deadline up to 6 months.

Helpful Resources for E-file 4868

Helpful Videos to E-File Form 4868

Recent Queries to E-File Form 4868

- When is the due date to file my Form 4868?

- [E-file Error Code F4868-001-02] How do I resolve it?

- [E-File Error Code F4868-002-01] How do I resolve it?

- What if I am an “Out-of-the-Country” tax filer filing Form 4868?

- What payment options do I see while e-filing 4868?

- Once my extension is approved, how can I find my extended date?